do travel nurses pay state taxes

Any phone Internet and computer-related expensesincluding warranties as well as apps and other. State travel tax for Travel Nurses.

W2 And 1099 Differences For Travel Nurses The Gypsy Nurse

Your blended rate is calculated by breaking down your non-taxable stipends into an hourly.

. In most situations yes. I could spend a long time on this but here is the 3-sentence definition. May 9 2019.

The costs of your uniforms including dry cleaning and laundry costs. Or are paid a fully taxable hourly wage taxed on the total rate of pay. Unfortunately you can only receive the tax-free stipend option if you can claim a permanent tax-home.

But setting the hourly wage too low carries some risks as well. It is common practice for states that charge income tax to tax travel nurses even though they might not be permanent residents of that state. Tax-Free Stipends for Housing Meals Incidentals.

Travel Nurse Tax Deduction 1. These stipends and reimbursements are for expenses such as meals parking transportation fees and housing. Two basic principles are at work here.

Each state return cannot be prepared in a vacuum as the results on one can be dependent on the other. Having a tax home will solve this problem. Tax deductions for travel nurses also include all expenses that are required for your job.

You can also be part of the tax advantage plan in which some expenses are tax-deductible and some are non-taxable. Do travel nurses pay state income tax in states where they work. How many states have state income tax.

1099 employees expecting to owe over 1000 in taxes have to file and pay taxes quarterly whereas W2 employees have taxes withheld every pay period but only have to file annually. Because Travel Nursing makes filing taxes more complex however the IRS is usually lenient when it comes to requesting extensions. If they can this is the fastest way.

First your home state will tax all income earned everywhere regardless of source. We sat down with tax expert Brendan Willmann to learn the secrets to paying less travel nurse taxes. The fact that the income was not earned in the home state is irrelevant.

1 Ask your agency to withholding for your work state AND additional amounts for your home state. When it comes to paying less travel nurse taxes Willmann says his most. You will owe both state where applicable and federal taxes like everyone else.

2000 a month for lodging non-taxable. As mentioned above 1099 travel nurses have to pay the 153 SE tax rather than ½ of FICA for W2 employees. Typically there are stipends or reimbursements for travel nurses.

Having no tax homes means they stay in hotels and hence more cost. The average monthly income for travel nurses is 9790 although this number can fluctuate based on factors such as the number of hours worked and any incentives receivedAnnual There is a wide range of variation in the annual compensation that travel nurses make on averageThey begin with a salary of 78430 but it may increase all the way up. 500 for travel reimbursement non-taxable.

States have a state income tax but Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming dont. Not just at tax time. This is helpful if your travel.

41 states have income tax. Like everyone else travel nurses pay tax on their income but the unique nature of travel nursing means its possible to lower your tax bill and keep more of your money in your pocket. Travel nurses are paid a blended rate of tax-free stipends and taxable hourly wage.

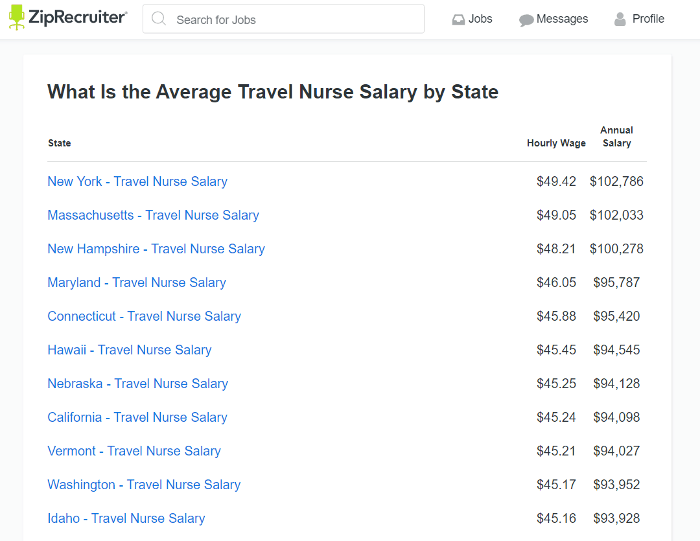

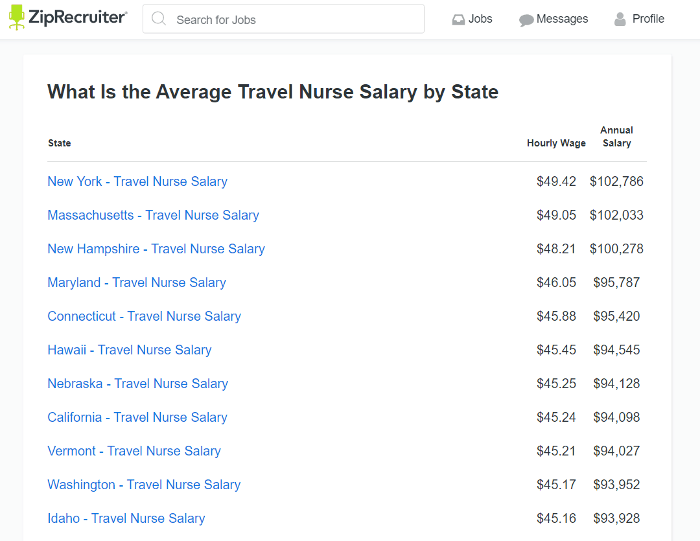

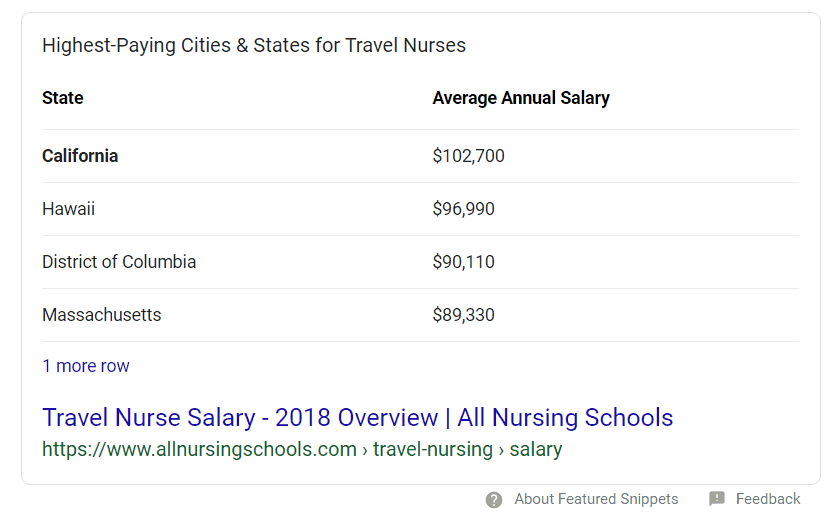

But many states including California use a percentage based approach to figuring out taxes due plus different personal exemptions so it may not be exact. Of the fifty United States nine dont require you to pay state income tax. Many travel nurses and travel nurse employers prefer the hourly wage number to be as low as possible so the tax liability will be lower.

It is also the most important since the determination of whether per diems stipends allowances or subsidies are taxable. 250 per week for meals and incidentals non-taxable. Some agencies will outright refuse to do this as it requires additional work to add a second state.

The only condition to qualify for Tax-Free income is that the traveler must be working in a state that is not their tax home. The 50 Mile Rule is one of the most common fallacies pertaining to tax-free reimbursements for travel nurses. Purveyors of this rule claim that it allows travel nurses to accept tax-free.

Travel nurses are granted tax-free stipends and travel nurses save up to 10k annually compared to permanent nurses. This is how a lot of travel nurses handle taxes. There are at least 4 ways to fill this gap.

Here is an example of a typical pay package. This is the most common Tax Questions of Travel Nurses we receive all year. Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming.

Tax break 3 Professional expenses. As a travel nurse working outside of your tax home you are eligible for tax-free stipends in addition to the hourly wages you earn. Where do travel nurses pay state income taxes.

In addition hourly wages are subject to federal income tax and state and local taxes that depend on where you live. Make sure to check state laws as you may end up paying state income taxes in more than one state if you live in one but work in another. Travel Nursing Pay The 50 Mile Myth for Tax Free Stipends.

Basically only income earned in California is taxed there. If your home state has a higher tax rate you have a gap to fill. You will pay state income taxes in whichever state you work.

There are two ways you can be paid as a travel nurse. The most prominent Travel Nurse Tax Deductions are Tax-Free Stipends for Housing Meals Incidentals Travel Reimbursements and Professional Development Costs. Also some states allow whats called a reciprocity agreement which requires you to pay tax for just one state where youve lived.

If you need more time feel free to ask for it. You may be subject to state income tax in both the state of your permanent residence and the states where you had travel nurse jobs. Its also worth really familiarizing yourself with the tax implications of working in a different state as the wage component of the total compensation package will translate differently as take-home pay from one state to the next.

Its prominent among both travel nurses and travel nursing recruiters. 20 per hour taxable base rate that is reported to the IRS. Know which states charge income tax.

At the same time the work state will. Also nurses are free to go anywhere in their breaks. 1 A tax home is your main area not state of work.

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

Travel Nurse Tax Pro Home Facebook

What Is An Average Housing Stipend For A Travel Nurse Trusted Nurse Staffing

Travel Nurse Taxes All You Need To Know Origin Travel Nurses

How To Make The Most Money As A Travel Nurse

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

Travel Nurse Taxes All You Need To Know Origin Travel Nurses

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

Travel Nurse Taxes How To Get The Highest Return Next Move Inc

What Travel Nurses Ought To Know About The Cost Adjusted Value Of Their Pay Bluepipes Blog

Travel Nurses Are In High Demand Are You Eligible To Travel Travel Nursing Travel Nursing Companies Nurse

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

Trusted Event Travel Nurse Taxes 101 Youtube

Understanding Pay Packages For Traveling Nurses 2021 Marvel Medical Staffing

How Much Do Travel Nurses Make Factors That Stack On The Cash

Travel Nurse Salary Comparably

Are There Red Flags For The Irs In Travel Nursing Pay Bluepipes Blog